Best Financial Reporting Software for Digital Agencies

Financial reporting is everyone’s favorite topic, right? ….right?

Financial reporting can feel overwhelming for some agency leaders and team members, so we’re here to help. We break down why financial reporting tools are important and how they’re used. There’s also a list of financial reporting software tools to consider for your agency below. Don’t worry: we detail how the Parallax platform fits into the financial reporting equation, too. Let’s dive in!

Table of Contents

- What is Financial Reporting Software?

- Why Digital Agencies Need Financial Reporting Tools

- 5 Key Features of Financial Reporting Software

- Best Financial Reporting Software for Digital Agencies

What Is Financial Reporting Software?

In the simplest terms, financial reporting software is a tool that enables digital agency leaders to track, manage, and analyze their financial data. It’s meant to help agencies monitor their financial health and performance, make informed business decisions, and plan for the future.

It’s typically used by agency owners, finance teams, and other key decision-makers to gain insights into their financial data and make strategic decisions. When implemented and leveraged properly, financial reporting software helps to streamline financial processes, reduce errors, and gain deeper insights into financial performance, enabling leaders to make better business decisions. 📈

Financial Reporting Software Use Cases

There are a variety of different use cases for financial reporting software for digital agencies, including analyzing profitability by client or project, tracking employee productivity, forecasting cash flow, and generating financial statements and reports for stakeholders.

Here’s what we usually see these solutions leveraged for:

- Budgeting and Forecasting: Financial reporting software can help digital agencies create budgets and financial forecasts. This can be done by analyzing historical data and predicting future trends, which can help leaders plan their resources and investments. It can also help identify potential cash flow problems before they occur, allowing leaders to take proactive measures to address them.

- Client Billing and Invoicing: Digital agencies often work with multiple clients, and financial reporting software can streamline the billing and invoicing process. This includes generating invoices based on agreed-upon billing rates, tracking time and expenses against projects, and reconciling payments received against outstanding invoices.

- Performance Tracking and Reporting: Leaders need to track various performance metrics to understand the effectiveness of their marketing campaigns and to optimize strategies as needed. Financial reporting software can be used to measure key performance indicators (KPIs) such as revenue, profit margins, client acquisition costs, and project profitability. This information can then be used to make informed decisions about resource allocation, client acquisition, and marketing strategies.

Why Digital Agencies Need Financial Reporting Tools

Financial reporting tools help digital agencies improve financial control, make better business decisions, and stay compliant with regulatory requirements. Here’s how:

- Financial Control: Financial reporting software helps digital shops and agencies maintain better control over their financial data, track expenses, and monitor revenue. These tools can provide insights into the profitability of individual projects, identify cost savings opportunities, and improve cash flow management.

- Business Decision-Making: Financial reporting tools provide leaders with the data they need to make informed business decisions. By tracking KPIs such as revenue growth, profit margins, and customer acquisition costs, leaders can make more strategic decisions around staffing, pricing, and resource allocation.

- Compliance: Agencies need to comply with various regulatory and tax requirements, and financial reporting tools can help automate many of these processes. By streamlining compliance tasks such as tax reporting, invoicing, and payroll, agencies can save time and reduce the risk of errors.

How Parallax Fits Into the Financial Reporting Equation

Is Parallax a financial reporting software solution? Nope! It’s an integrated resource planning, capacity planning, and active forecasting tool that gives project managers and leadership a real-time view into project financial performance and projections (think: sold vs. actuals and project margin). Parallax integrates with other valuable tools like CRMs and project management and time-tracking solutions, allowing performance and forecasting data to be exported and used alongside financial reporting systems to help provide strategic insights for optimizing performance today and planning for tomorrow.

Drilling down to the project level, Parallax monitors revenue and margin against set plans and provides real-time insights to help teams understand performance in real-time. It also supports multiple billing models (i.e., time and materials, fixed fee, or retainer) and tracks team performance and costs throughout a project to reduce surprises and overages.

On the resourcing and capacity planning front, Parallax makes managing a team across several different projects easier by tracking hours and costs with consistency. In addition, it connects data between sales and resource teams to help sales attach directionally accurate resource plans to deals as early as possible to avoid any resourcing (or financial!) hiccups.

Ultimately, by making real-time performance and forecasting data available alongside financial reporting software insights, the Parallax platform arms digital agency leaders with the information they need to make smart decisions and to keep their people focused on doing their best work.

5 Key Features of Financial Reporting Software

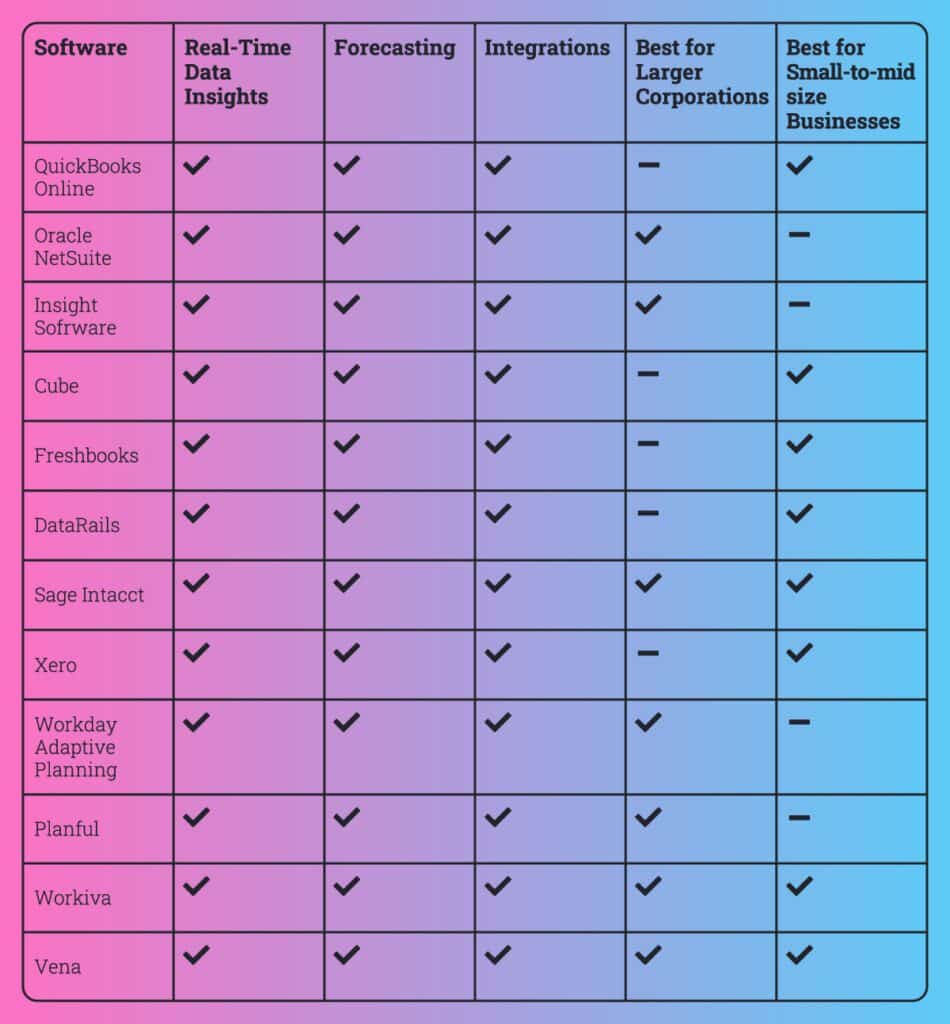

#1. Real-Time Data Insights

Digital agency leaders need financial insights (income and expense tracking, invoice and payment tracking, tax reporting, etc.) from their financial reporting software to make informed business decisions promptly. These insights give them a clear understanding of their company’s financial performance at any given time and help them identify potential issues before they become significant problems.

#2. Forecasting

Without financial forecasting capabilities, leaders would have a limited understanding of their business’s future financial performances. With forecasting capabilities, they’re able to see beyond the current financial period and plan for long-term success. Look for financial reporting software that helps to identify potential opportunities and risks that may affect the business and shows where and how leaders could make adjustments to their operations based on the forecasted financial outcomes.

#3. Integrations

When financial reporting software integrates with other important solutions and tools, agencies experience streamlined operations and greater efficiencies across the business. Take integrations with project management (PM) tools, for example: when financial reporting software connects with PM tools, team leaders and project managers can more easily track project expenses, manage budgets, and track the profitability of each project. There’s also key benefits of integrating financial reporting software with payment processing solutions, CRM systems, payroll systems, inventory management tools, and more.

#4. Best for Larger Corporations

For larger corporations, financial reporting software solutions typically offer more advanced features such as multi-entity management, multi-currency support, and more in-depth reporting capabilities. These organizations often have more complex financial needs and require software that can handle the volume of data and transactions they generate. They also typically have larger budgets to invest in more expensive software solutions.

#5. Best for Small-to-midsize Businesses

Small-to-midsize businesses may not require the same level of complexity and features as larger corporations. They usually have simpler financial reporting needs and tend to require more affordable software solutions. They also may not have the same resources and technical expertise to manage more complex software solutions, so the team may benefit from software solutions that offer more user-friendly interfaces and ease of use.

Best Financial Reporting Software for Digital Agencies

There are a lot of tools on the market to consider and demo to understand which solution may work best for your unique needs. Here’s a starter list to consider:

#1. QuickBooks Online

QuickBooks Online is a robust financial reporting and accounting software solution that offers automation, customization, and integrations that can help digital agency leaders manage their finances more effectively. One standout feature of QuickBooks Online is its ability to automate many financial tasks, such as invoicing, payment processing, and expense tracking. Another unique feature is its customizable reporting capabilities. Users can create custom reports that provide insights into key financial metrics, such as revenue, profit, and cash flow.

#2. Oracle NetSuite

Oracle NetSuite is a cloud-based financial management system that provides end-to-end accounting and financial management capabilities. It offers features such as real-time financial reporting, order and billing management, revenue recognition, and inventory management as well as customizable dashboards and reporting tools. Its multi-currency and multi-language capabilities make it ideal for global operations. Additionally, NetSuite offers robust integration capabilities, allowing for seamless integration with third-party applications and systems.

#3. Insight Software

Insight Software is a financial reporting and business intelligence solution designed for midsize to large businesses that need robust financial reporting and analysis capabilities. It offers features such as real-time data integration from multiple sources, customized dashboards, and ad-hoc reporting capabilities, and it provides financial consolidation, budgeting, forecasting, and planning tools to help businesses make informed financial decisions. It offers a user-friendly interface and intuitive reporting tools to help users quickly analyze and visualize their data.

#4. Cube

Cube offers features such as customizable dashboards, ad-hoc reporting, and drill-down capabilities to help users quickly analyze their data. Cube provides forecasting and budgeting tools to help businesses make informed financial decisions, and it integrates with other financial and accounting software, such as QuickBooks, Sage, and Xero, to consolidate financial data and streamline reporting processes. It’s designed for small to medium-sized businesses that need real-time financial insights to make data-driven decisions.

#5. Freshbooks

Freshbooks is a cloud-based accounting and invoicing software designed for small businesses and freelancers. It offers a user-friendly interface and easy-to-use features such as time tracking, project management, and automatic billing. One of its unique features is the ability to accept online payments directly from invoices. Freshbooks also offers a variety of customizable templates for invoices, estimates, and proposals. Its mobile app allows users to track expenses and manage invoices on-the-go. Additionally, Freshbooks integrates with a variety of third-party apps such as PayPal, Stripe, and G Suite to streamline business processes.

#6. DataRails

DataRails is a financial reporting solution that is designed to automate spreadsheet management and enhance data accuracy. Its unique feature is the ability to provide a unified view of financial data from multiple sources, including ERP systems, CRMs, and other financial applications. The software also uses machine learning to identify patterns and errors in financial data, improving the accuracy of financial reporting. With DataRails, users can easily collaborate on spreadsheets in real-time, track changes, and manage access permissions. The solution provides users with a dashboard that displays key metrics and KPIs, and allows users to drill down into financial data to gain insights.

#7. Sage Intacct

Sage Intacct is designed to streamline accounting processes and enable businesses to make better financial decisions. Its unique features include advanced automation, multi-entity consolidation, real-time dashboards, and built-in compliance tools. It offers comprehensive financial management tools such as accounts payable and receivable, general ledger, and cash management. Sage Intacct integrates with other business systems to provide a complete financial management solution, and its flexible platform can scale to meet the needs of growing businesses, making it a popular choice for mid-sized companies.

#8. Xero

Xero helps small-to-medium-sized businesses manage their finances with ease. Its unique features include automatic bank feeds, easy invoicing and payment processing, expense tracking, and financial reporting. Xero allows users to create custom reports and dashboards, and offers an ecosystem of third-party apps and integrations for added functionality. Its mobile app provides real-time access to financial data, and its multi-currency support makes it ideal for businesses operating internationally.

#9. Workday Adaptive Planning

Workday Adaptive Planning enables businesses to create financial forecasts and models. With its intuitive interface and flexible modeling capabilities, it allows users to build custom models, set financial goals and budgets, and track progress against those goals. It also offers advanced analytics and scenario planning tools that allow businesses to anticipate changes in the market and plan accordingly. Additionally, the software integrates with a wide range of ERP systems and other applications, making it easy to share data and streamline workflows.

#10. Planful

Planful is a cloud-based financial planning and analysis (FP&A) platform that provides various features such as budgeting, forecasting, reporting, consolidations, and analytics. With Planful, companies can create and manage complex financial models, visualize their data, and generate insightful reports. Its automation capabilities can help reduce the manual workload and increase accuracy in financial planning and analysis. Planful’s open API allows integration with various systems, including ERPs, CRMs, and HR systems, to provide a complete view of the organization’s performance.

#11. Workiva

Workiva provides a single platform to manage and automate reporting processes. It enables users to seamlessly collaborate on reports with colleagues, reviewers, and auditors in real-time, and its real-time data monitoring capabilities allow users to track changes, flag issues, and drill down into details, providing a comprehensive view of financial performance. Users can also integrate with external data sources, such as ERP systems and other financial applications, to automate data input and streamline reporting processes. Additionally, Workiva provides various compliance and regulatory features that ensure data accuracy, consistency, and completeness, making it an ideal solution for companies of all sizes, particularly those with complex financial reporting needs.

#12. Vena

Vena is designed to help businesses automate budgeting, planning, and forecasting processes. Its unique features include the ability to automate complex financial processes such as consolidation, data validation, and currency translation. It also offers a centralized data repository that allows users to easily manage and access financial data from multiple sources. Overall, Vena is an ideal solution for businesses looking to streamline their financial processes, improve their forecasting accuracy, and gain valuable insights into their financial performance.

Connect with Parallax

Interested in learning how Parallax works alongside financial reporting solutions? We’re more than happy to talk through any questions you have. So, when you’re ready to chat, we’re ready to chat. 🤝